Lump sum pension payout calculator

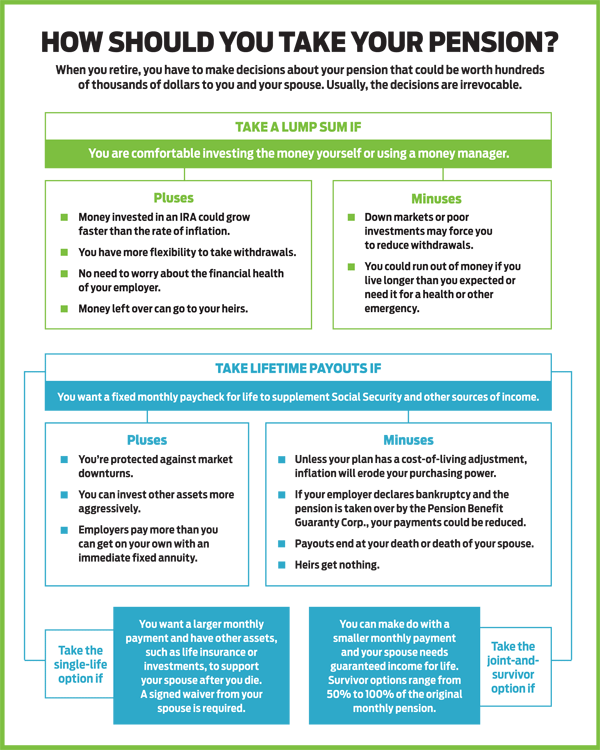

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Why Take a Lump Sum Pension Payout.

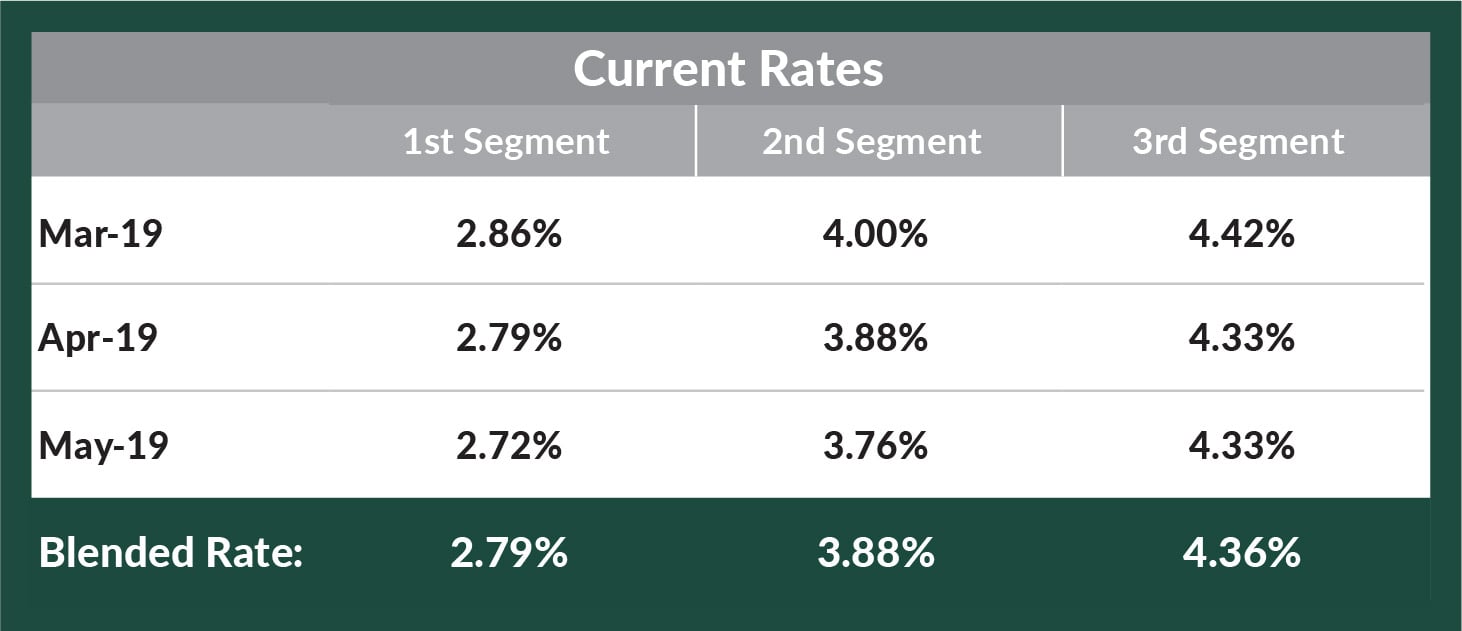

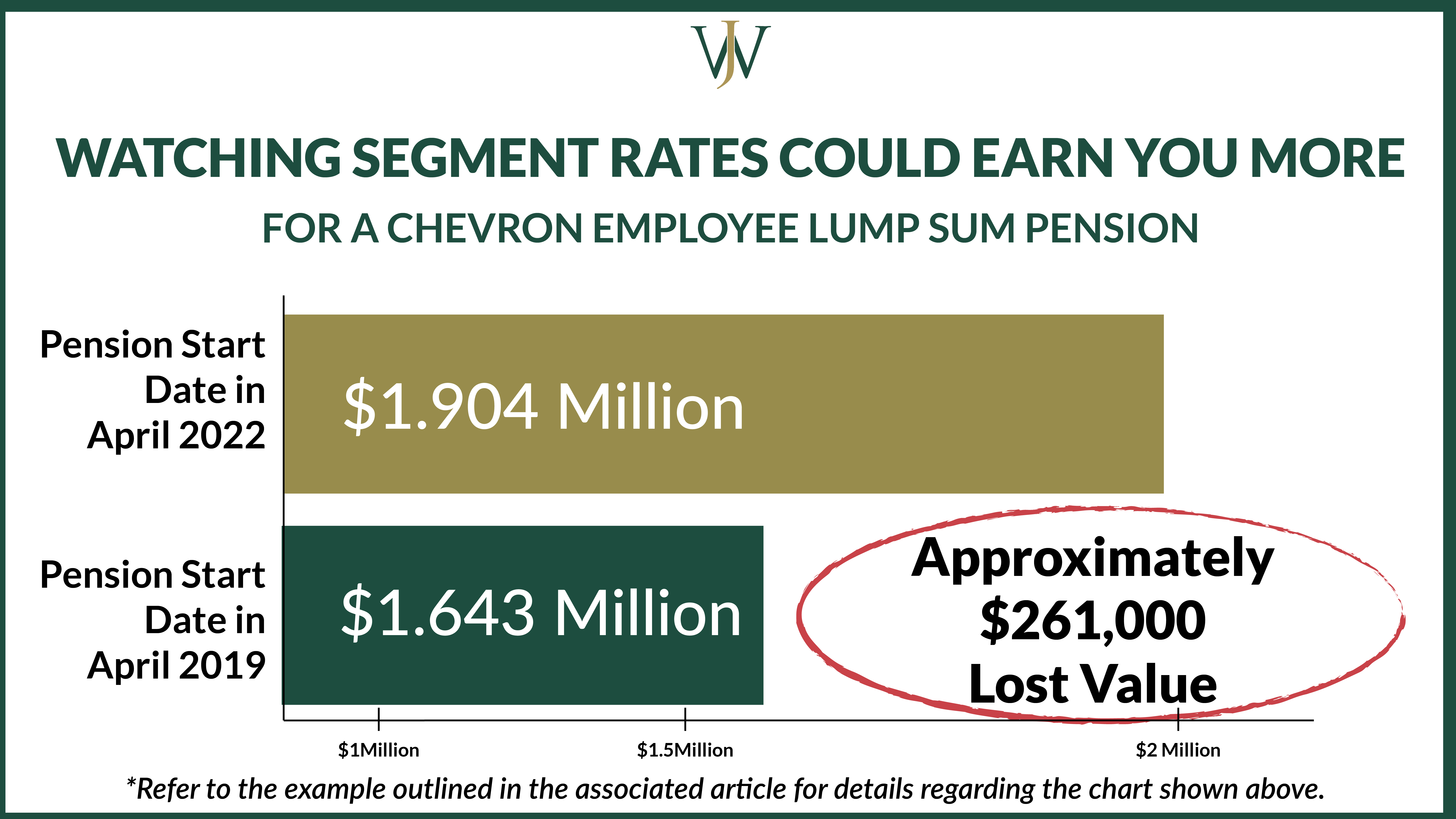

How To Pick Your Retirement Date To Optimize Your Chevron Pension

The 30-Year Treasury rate has been rising this year but is still lower than the historical average of 479.

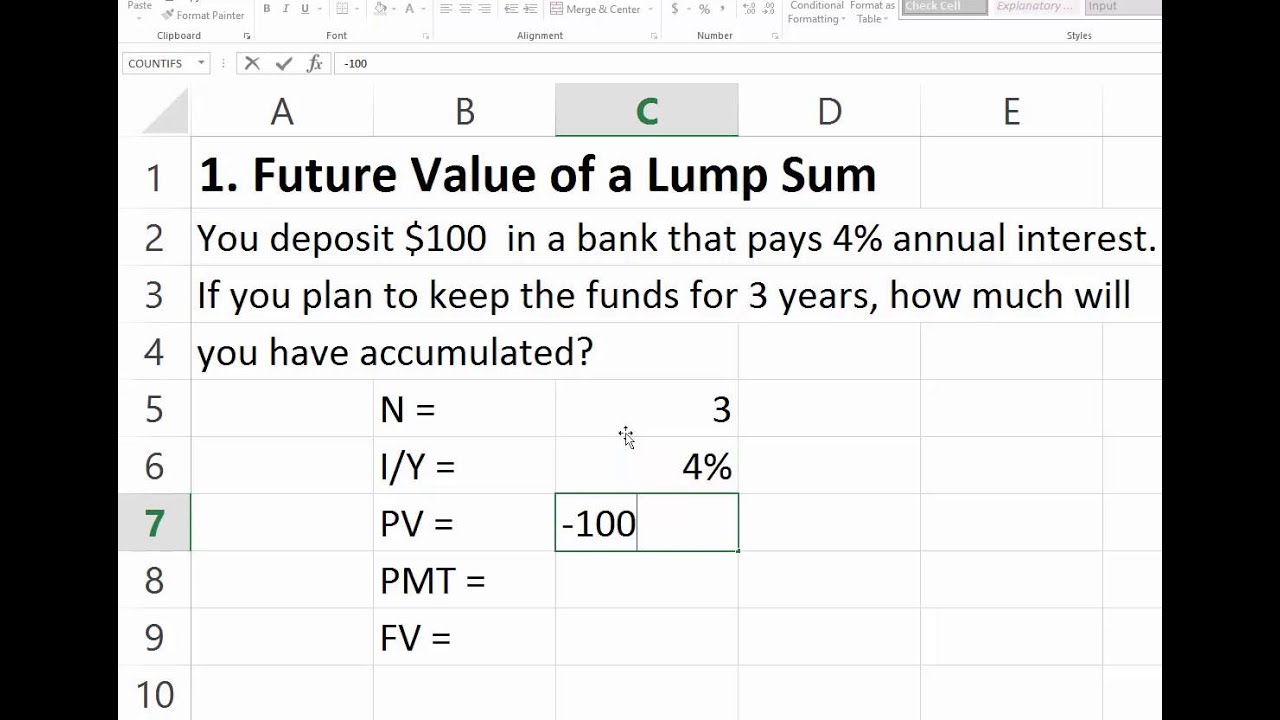

. This calculator will help you figure out how much income tax youll pay on a lump. Dont worry its only negative because thats representing a cash outflow. Find out what the required annual rate of return required would be for.

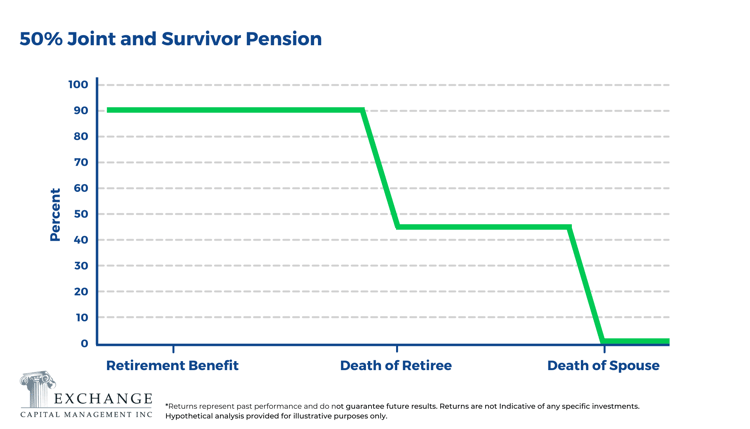

Our lump sum vs. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated. Lump-Sum The lump-sum payment option allows annuitants to withdraw the entire account value of an annuity in a single withdrawal.

Employees often consider taking a lump sum pension payout for three common reasons. You have access to the cash you. Calculate 115 of the average.

Try the free Pension vs. This could mean your pension lump sum would be higher than. To find out how this works in detail you can read our guide Should I take a lump sum from my pension.

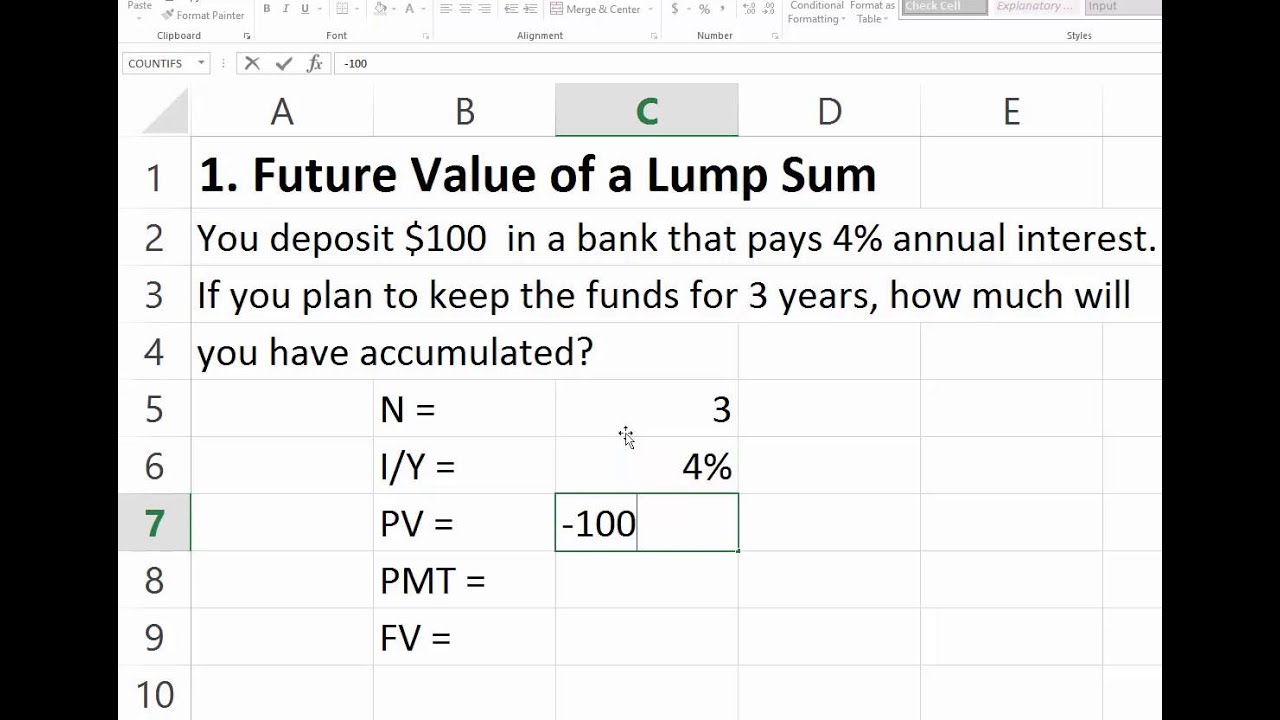

Find a Branch Contact a Financial Advisor Finras Brokercheck CALL 1-877-579-5353. Receiving a lump sum. In Column C enter the lump sum as a negative number in the year the lump sum is paid out.

Find out what the required annual rate of return required would be for. How to Avoid Taxes on a Lump Sum Pension Payout. Find out what the required annual rate of return required would be for.

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. This is known as a lump-sum payout option. Find out what the required annual rate of return required would be for.

A simplified illustration. A one-time payment for all or a portion of their pension. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

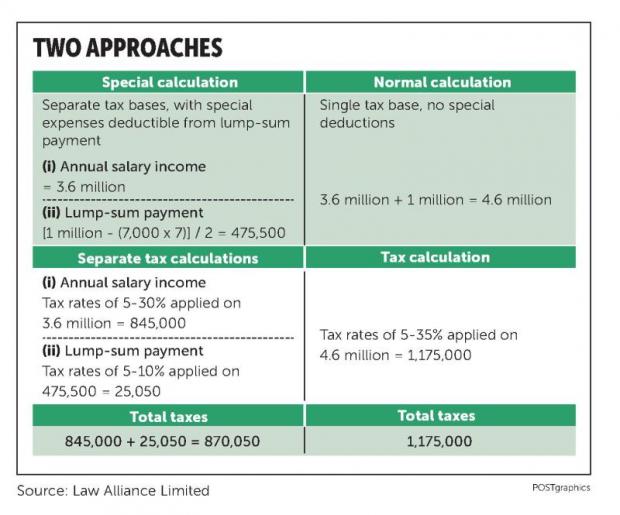

If you choose a lump-sum payout instead of monthly payments the responsibility for. Calculate average annual pay for last three years. We have the SARS tax rates tables.

Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. Calculation of tax relief on Eileens retirement lump sum Calculation Value.

Find out what the required annual rate of return required would be for. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Annuity payment calculator compares two payment options.

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Both are represented by tabs on the calculator.

Strategies To Maximize Pension Vs Lump Sum Decisions

Annuity Formula With Graph And Calculator Link

Lump Sum Pension Payments Wiser Women

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Put Your Pension To Work Immediateannuities Com

Lottery Payout Options Annuity Vs Lump Sum

Pension Decision Are You Better Off With An Annuity Or A Lump Sum Payout Seeking Alpha

Cracking The Code Choosing Between A Pension And Lump Sum

Strategies To Maximize Pension Vs Lump Sum Decisions

Strategies To Maximize Pension Vs Lump Sum Decisions

How Retirement Benefits Are Paid The Western Conference Of Teamsters Pension Trust

Lump Sum Sip Calculator Financeplusinsurance

Future Value Of A Lump Sum Using Excel Youtube

Estimate Your Benefits Arizona State Retirement System

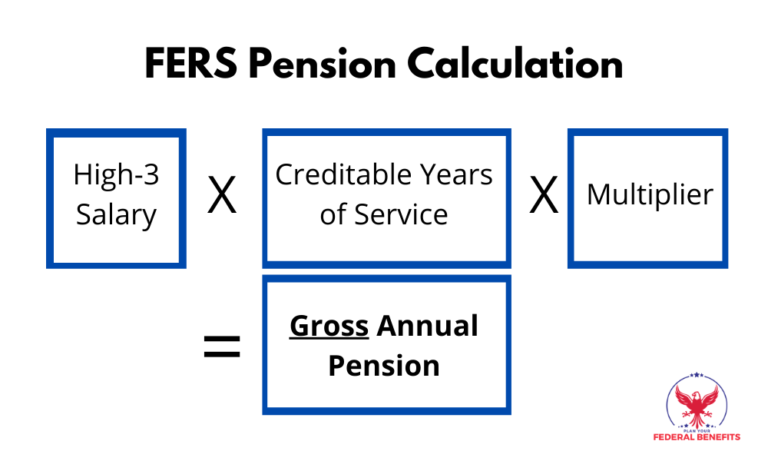

Can I Take My Fers Pension As A Lump Sum Government Deal Funding

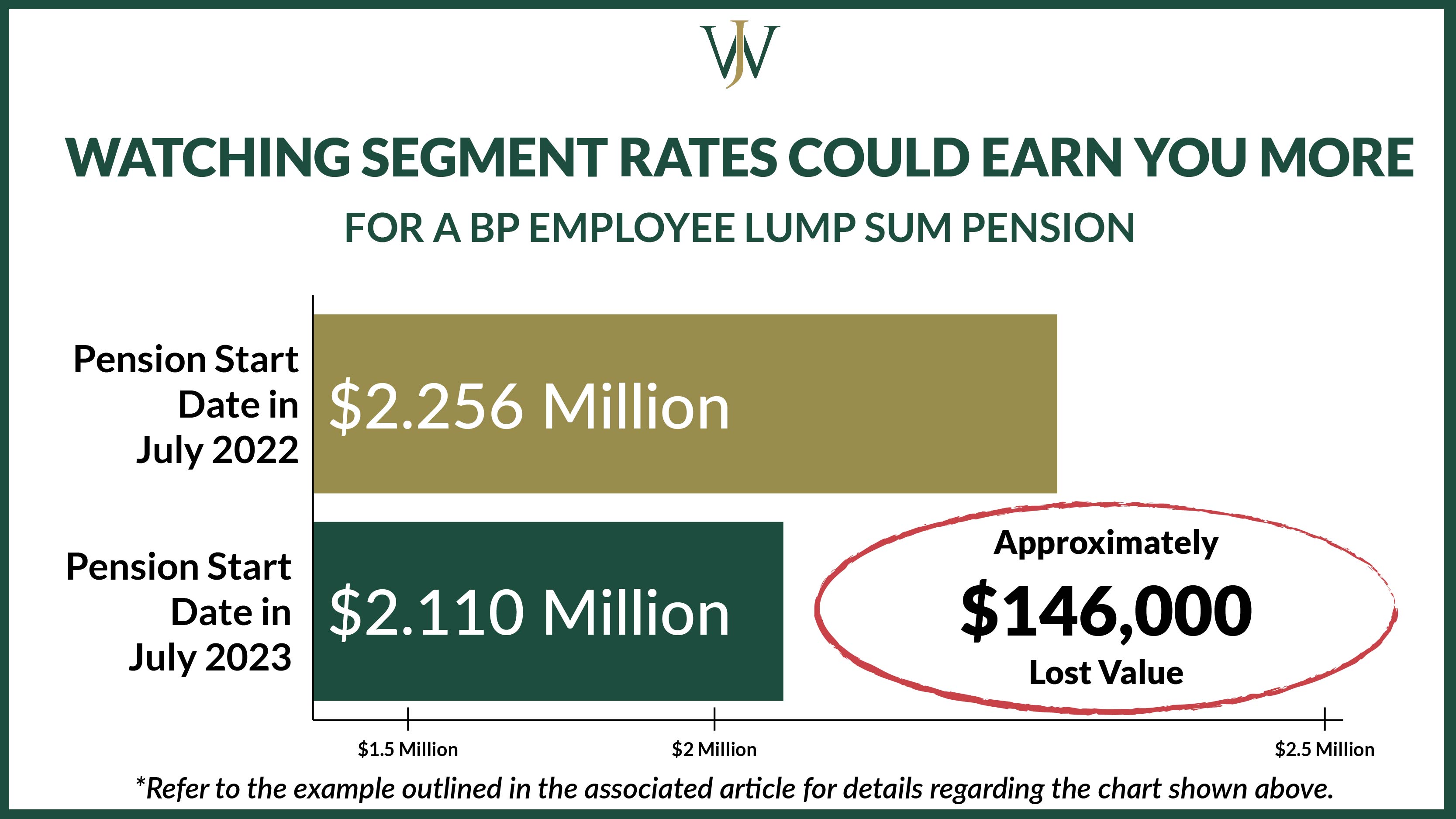

Why Optimizing Your Bp Pension Comes Down To Timing

Lump Sum Payments To Departing Employees